Understanding Calendar Yr Deductibles: A Complete Information

Associated Articles: Understanding Calendar Yr Deductibles: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Understanding Calendar Yr Deductibles: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Understanding Calendar Yr Deductibles: A Complete Information

The idea of a calendar 12 months deductible, whereas seemingly easy, generally is a supply of confusion for a lot of people navigating the complexities of medical insurance. This text supplies a complete overview of calendar 12 months deductibles, exploring their nuances, variations, and implications for healthcare shoppers. We’ll delve deep into the subject, inspecting several types of deductibles, methods for managing them, and the significance of understanding your particular plan’s provisions.

What’s a Calendar Yr Deductible?

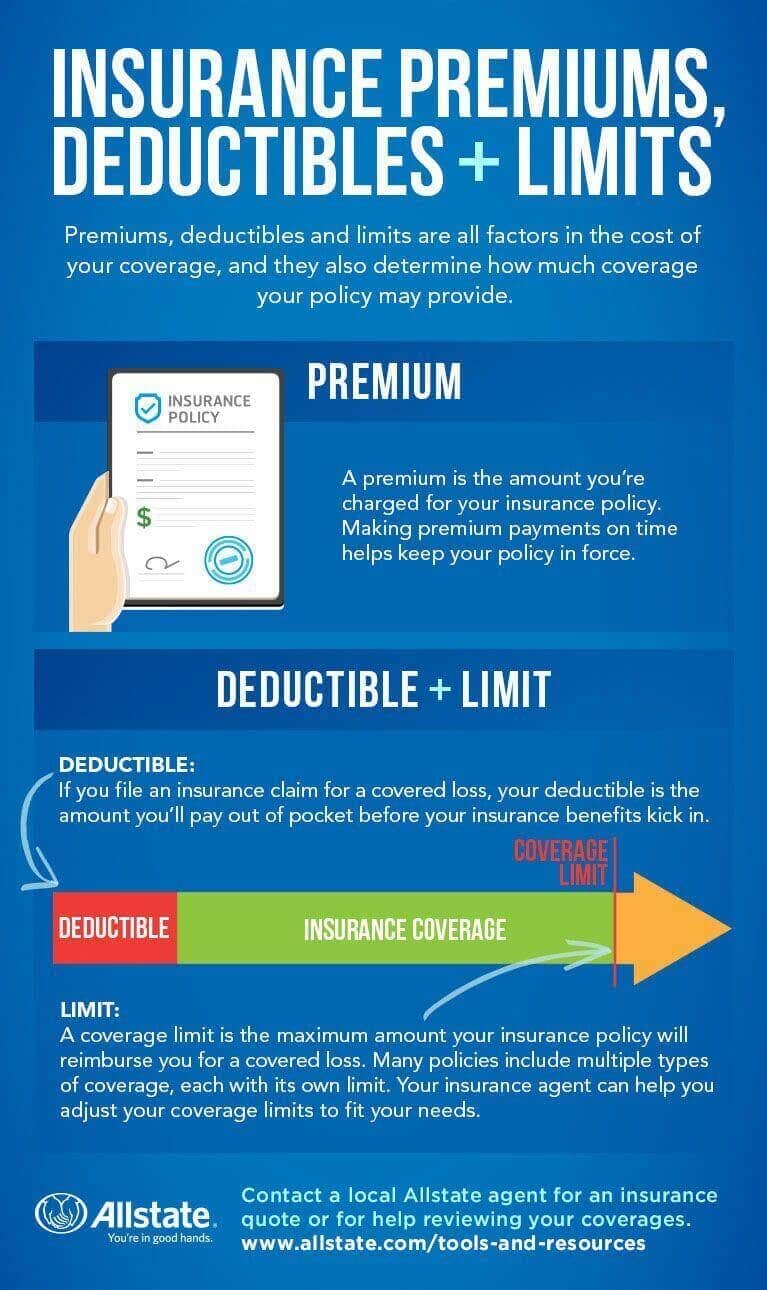

A calendar 12 months deductible is the sum of money you should pay out-of-pocket for coated healthcare companies earlier than your medical insurance plan begins to pay its share. Crucially, this deductible resets at the start of every calendar 12 months (January 1st). As soon as you’ve got met your deductible, your insurance coverage firm sometimes pays a proportion of the remaining eligible medical bills, as outlined in your coverage’s phrases. This proportion is also known as coinsurance.

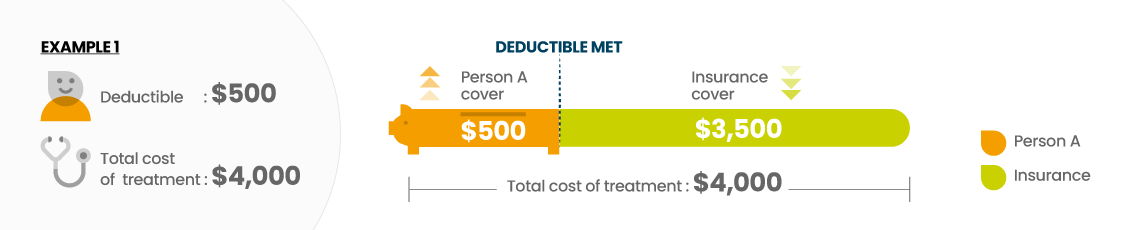

Let’s illustrate with an instance:

Think about you may have a medical insurance plan with a $2,000 calendar 12 months deductible and a 20% coinsurance. In the event you incur $3,000 in eligible medical bills in January, you will pay the complete $2,000 deductible upfront. After assembly the deductible, your insurance coverage firm pays 80% of the remaining $1,000 ($800), and you’ll pay the remaining 20% ($200). Nonetheless, when you incur one other $1,000 in bills in December of the identical 12 months, your insurance coverage will cowl 80% of that quantity immediately, as you’ve got already met your deductible.

Variations and Nuances:

The simplicity of the above instance belies the complexity that may come up in real-world eventualities. A number of elements can affect your expertise with a calendar 12 months deductible:

-

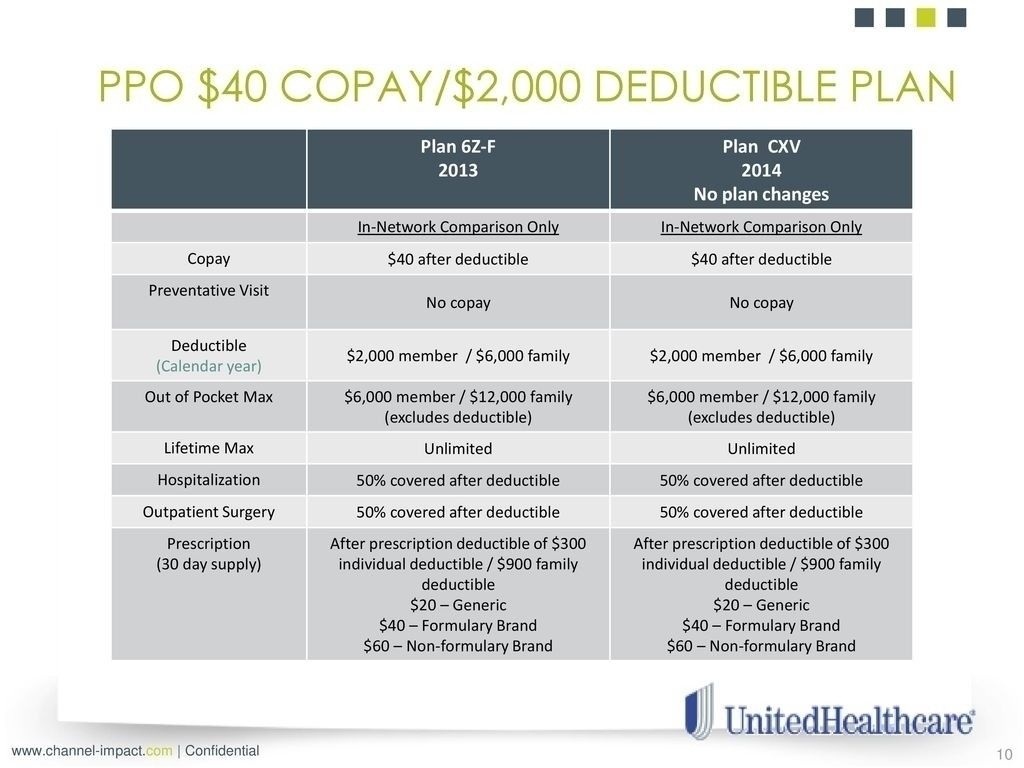

Particular person vs. Household Deductible: Some plans supply particular person deductibles, the place every coated particular person on the plan has their very own separate deductible. Others have a household deductible, that means the full quantity the complete household should meet earlier than the insurance coverage begins paying its share. A household deductible is normally larger than a person deductible. Selecting between these relies upon closely on the household’s anticipated healthcare wants.

-

In-Community vs. Out-of-Community Deductibles: Many plans have separate deductibles for in-network and out-of-network suppliers. In-network suppliers are those that have contracted along with your insurance coverage firm to offer companies at a negotiated charge. Utilizing out-of-network suppliers usually ends in larger prices and doubtlessly a better out-of-pocket deductible. It is essential to grasp these variations to keep away from sudden bills.

-

Particular Service Deductibles: Sure companies, like imaginative and prescient or dental care, may need separate deductibles, even when they’re a part of a complete medical insurance plan. These are sometimes separate from the final medical deductible.

-

Excessive-Deductible Well being Plans (HDHPs): HDHPs function considerably larger deductibles than conventional plans. These plans are sometimes paired with a Well being Financial savings Account (HSA), permitting pre-tax contributions for use to pay for medical bills, together with deductible quantities. HDHPs will be cost-effective for people who’re usually wholesome and anticipate low healthcare utilization.

-

Deductible vs. Out-of-Pocket Most: It is important to distinguish between the deductible and the out-of-pocket most. The out-of-pocket most is probably the most you will pay in a calendar 12 months for coated companies. When you attain this restrict, your insurance coverage will cowl 100% of eligible bills for the rest of the 12 months. This supplies essential safety towards catastrophic medical prices.

Methods for Managing Your Calendar Yr Deductible:

Successfully managing your calendar 12 months deductible requires proactive planning and consciousness:

-

Perceive Your Plan: Completely evaluation your insurance coverage coverage to grasp the precise particulars of your deductible, together with whether or not it is a person or household deductible, in-network/out-of-network implications, and any separate deductibles for particular companies.

-

Preventive Care: Reap the benefits of preventive companies coated by your plan, akin to annual checkups and vaccinations. These are sometimes coated without charge, even earlier than you meet your deductible.

-

HSA or FSA: In case you have an HDHP, maximize contributions to your Well being Financial savings Account (HSA). HSAs supply tax benefits and help you save pre-tax {dollars} to pay for medical bills, together with your deductible. Versatile Spending Accounts (FSAs) supply comparable advantages, however with much less flexibility and a “use it or lose it” provision.

-

Negotiate Prices: Do not hesitate to barter costs with healthcare suppliers. Many are prepared to work with sufferers to seek out reasonably priced fee choices.

-

Store Round: Evaluate costs for procedures and companies earlier than scheduling appointments. Use on-line instruments and assets to seek out probably the most cost-effective choices.

-

Monitor Your Bills: Preserve meticulous data of all of your medical bills all year long. This can assist you observe your progress in direction of assembly your deductible and guarantee correct reimbursement out of your insurance coverage firm.

-

Prioritize Care: Contemplate the urgency of medical procedures. If doable, postpone non-urgent care till after you’ve got met your deductible.

-

Contemplate Catastrophic Sickness Insurance coverage: For people with high-deductible plans, a catastrophic sickness insurance coverage coverage can supply extra safety towards sudden and substantial medical bills.

The Significance of Understanding Your Deductible:

Understanding your calendar 12 months deductible is paramount for efficient healthcare monetary planning. Failure to understand these particulars can result in sudden and doubtlessly substantial out-of-pocket bills. By understanding the nuances of your plan and implementing applicable methods, you may navigate the complexities of healthcare prices extra successfully and keep away from monetary surprises.

Conclusion:

Calendar 12 months deductibles are a basic element of most medical insurance plans. Whereas they’ll appear daunting, understanding their intricacies is essential for managing healthcare prices. By proactively reviewing your coverage, using accessible monetary instruments, and implementing efficient methods, you may mitigate the impression of your deductible and make sure that you obtain the mandatory healthcare with out undue monetary pressure. Keep in mind to all the time seek the advice of your insurance coverage supplier or a professional monetary advisor for customized recommendation tailor-made to your particular circumstances. The data offered on this article is for normal information and informational functions solely, and doesn’t represent monetary or medical recommendation.

Closure

Thus, we hope this text has offered precious insights into Understanding Calendar Yr Deductibles: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!