Navigating the 2024 Semi-Month-to-month Payroll Calendar: A Trendy Information for Employers and Staff

Associated Articles: Navigating the 2024 Semi-Month-to-month Payroll Calendar: A Trendy Information for Employers and Staff

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Navigating the 2024 Semi-Month-to-month Payroll Calendar: A Trendy Information for Employers and Staff. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the 2024 Semi-Month-to-month Payroll Calendar: A Trendy Information for Employers and Staff

The 12 months 2024 presents a contemporary set of challenges and alternatives for companies, and managing payroll effectively is paramount. For organizations working on a semi-monthly payroll schedule, understanding the calendar and its implications is essential for correct funds, compliance, and sustaining a optimistic worker expertise. This complete information delves into the intricacies of the 2024 semi-monthly payroll calendar, providing trendy methods for environment friendly processing and addressing widespread considerations.

Understanding the Semi-Month-to-month Payroll Cycle:

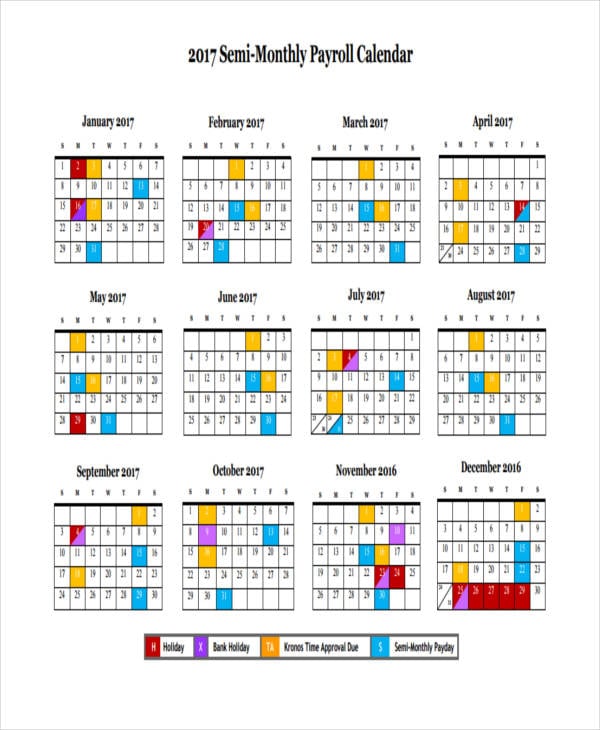

In contrast to bi-weekly payrolls (paid each two weeks), semi-monthly payrolls are issued twice a month, usually on a set day of the primary and final halves of the month. This usually interprets to cost on, for instance, the fifteenth and the final day of the month (or the closest enterprise day if these dates fall on a weekend or vacation). This consistency will be helpful for budgeting and monetary planning for each employers and staff.

The 2024 Semi-Month-to-month Payroll Calendar: Key Concerns:

The 2024 calendar presents a singular set of dates. To create an correct payroll calendar, it is advisable to think about:

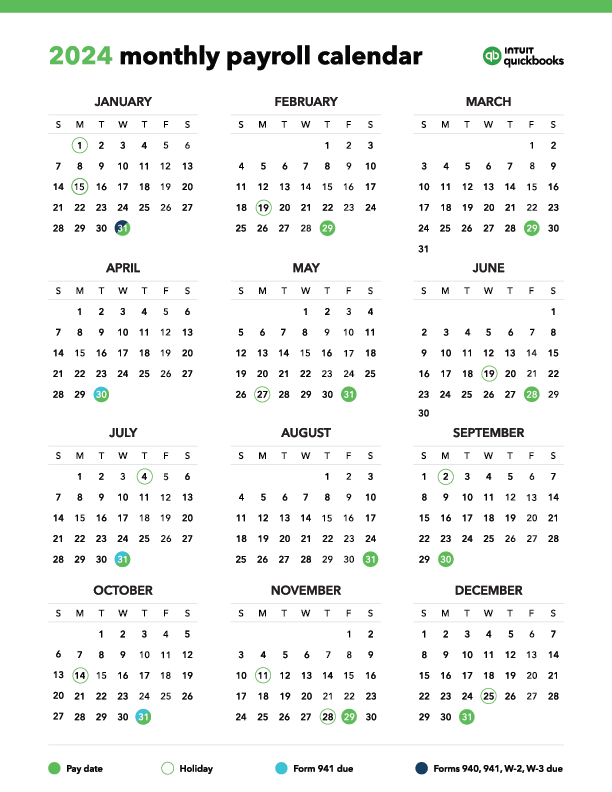

- Variety of Pay Durations: A semi-monthly payroll in 2024 will encompass 24 pay durations.

- Various Pay Interval Lengths: Because of the various variety of days in every month, the size of every pay interval will fluctuate. This necessitates cautious calculation of hours labored and different payroll deductions.

- Holidays and Weekends: Paydays falling on weekends or holidays require advance planning to make sure well timed cost and keep away from potential confusion. Most organizations will regulate the payday to the previous Friday or the next Monday.

- 12 months-Finish Processing: The ultimate pay interval of the 12 months wants particular consideration for year-end tax reporting and bonus funds.

Creating Your 2024 Semi-Month-to-month Payroll Calendar:

Whereas quite a few on-line payroll calculators and calendar mills exist, creating your individual custom-made calendar permits for higher management and accuracy. Think about these steps:

- Select your paydays: Choose constant paydays for the primary and second half of every month. Keep in mind to think about enterprise wants and worker preferences. Widespread decisions embrace the fifteenth and the final day of the month, or the closest enterprise day.

- Account for holidays: Establish all federal and state holidays in 2024 and regulate your paydays accordingly. A clearly marked calendar will stop unintended missed funds.

- Use a spreadsheet or calendar software program: Make the most of spreadsheet software program (like Microsoft Excel or Google Sheets) or specialised calendar functions to create a visible illustration of your payroll calendar. This permits for straightforward monitoring and future reference.

- Embrace key deadlines: Incorporate different essential payroll-related deadlines, akin to tax submitting deadlines, profit enrollment durations, and different related dates.

- Talk the calendar: Share the finalized calendar along with your staff and payroll division to make sure transparency and keep away from any misunderstandings.

Modernizing Your Semi-Month-to-month Payroll Course of:

The fashionable office calls for environment friendly and correct payroll processing. Listed below are some methods to streamline your semi-monthly payroll in 2024:

- Payroll Software program: Spend money on sturdy payroll software program that automates many features of payroll processing, from calculating wages and deductions to producing pay stubs and tax experiences. This reduces handbook errors and frees up worthwhile time.

- Time and Attendance Methods: Combine a time and attendance system along with your payroll software program for correct monitoring of worker hours. This minimizes discrepancies and ensures truthful compensation.

- Direct Deposit: Supply direct deposit as the first cost methodology. That is sooner, safer, and extra handy for workers.

- Cloud-Based mostly Options: Think about cloud-based payroll options for accessibility, scalability, and information safety. Cloud options usually supply computerized updates and improved collaboration options.

- Automation of Deductions: Automate the calculation and deduction of taxes, insurance coverage premiums, and different worker deductions to reduce errors and enhance accuracy.

- Worker Self-Service Portals: Present staff with entry to a web based portal the place they’ll view pay stubs, replace private data, and entry different payroll-related paperwork. This empowers staff and reduces administrative burden.

- Common Audits and Reconciliation: Conduct common audits of your payroll information to make sure accuracy and establish any potential discrepancies. Reconcile your payroll accounts often to keep up monetary integrity.

Addressing Widespread Challenges:

- Managing Various Pay Interval Lengths: Use a payroll system that mechanically adjusts calculations primarily based on the variety of days in every pay interval.

- Vacation Pay: Clearly outline your organization’s coverage concerning vacation pay and guarantee constant utility.

- 12 months-Finish Reporting: Put together for year-end tax reporting effectively prematurely. Familiarize your self with all related tax laws and deadlines.

- Worker Queries: Set up a transparent communication channel for workers to handle payroll-related questions and considerations. Present immediate and correct responses.

- Information Safety: Prioritize information safety by implementing sturdy safety measures to guard delicate worker data.

The Significance of Compliance:

Staying compliant with all federal, state, and native payroll laws is paramount. Failure to conform may end up in vital penalties and authorized repercussions. Keep up to date on modifications in payroll legal guidelines and laws, and think about consulting with a payroll specialist or tax skilled to make sure compliance.

Conclusion:

The 2024 semi-monthly payroll calendar presents a selected set of challenges and alternatives. By using trendy payroll applied sciences, implementing environment friendly processes, and prioritizing compliance, organizations can navigate the complexities of semi-monthly payroll successfully. A well-planned and executed payroll system ensures correct and well timed funds, fosters a optimistic worker expertise, and contributes to total enterprise success. Proactive planning, common overview, and a dedication to accuracy are key to a clean and profitable payroll 12 months in 2024. Keep in mind to seek the advice of with payroll professionals and make the most of the obtainable sources to make sure compliance and optimize your payroll processes. A well-managed payroll system is an funding within the effectivity and well-being of your group.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the 2024 Semi-Month-to-month Payroll Calendar: A Trendy Information for Employers and Staff. We thanks for taking the time to learn this text. See you in our subsequent article!