plan 12 months vs calendar 12 months Modern Excellent Superior

Associated Articles: plan 12 months vs calendar 12 months Modern Excellent Superior

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to plan 12 months vs calendar 12 months Modern Excellent Superior. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Plan 12 months vs. Calendar 12 months: Optimizing Your Enterprise Technique for Success

The best way your enterprise organizes its fiscal 12 months considerably impacts operational effectivity, monetary reporting, and strategic planning. Selecting between a plan 12 months and a calendar 12 months is a vital choice that calls for cautious consideration of your particular business, enterprise mannequin, and long-term objectives. Whereas a calendar 12 months (January 1st to December thirty first) affords simplicity and widespread familiarity, a plan 12 months – a 12-month interval starting on any date – supplies alternatives for strategic benefit. This text delves into the nuances of plan 12 months versus calendar 12 months accounting, exploring their benefits and drawbacks, and finally guiding you towards making the optimum selection to your group.

Understanding the Fundamentals: Calendar 12 months vs. Plan 12 months

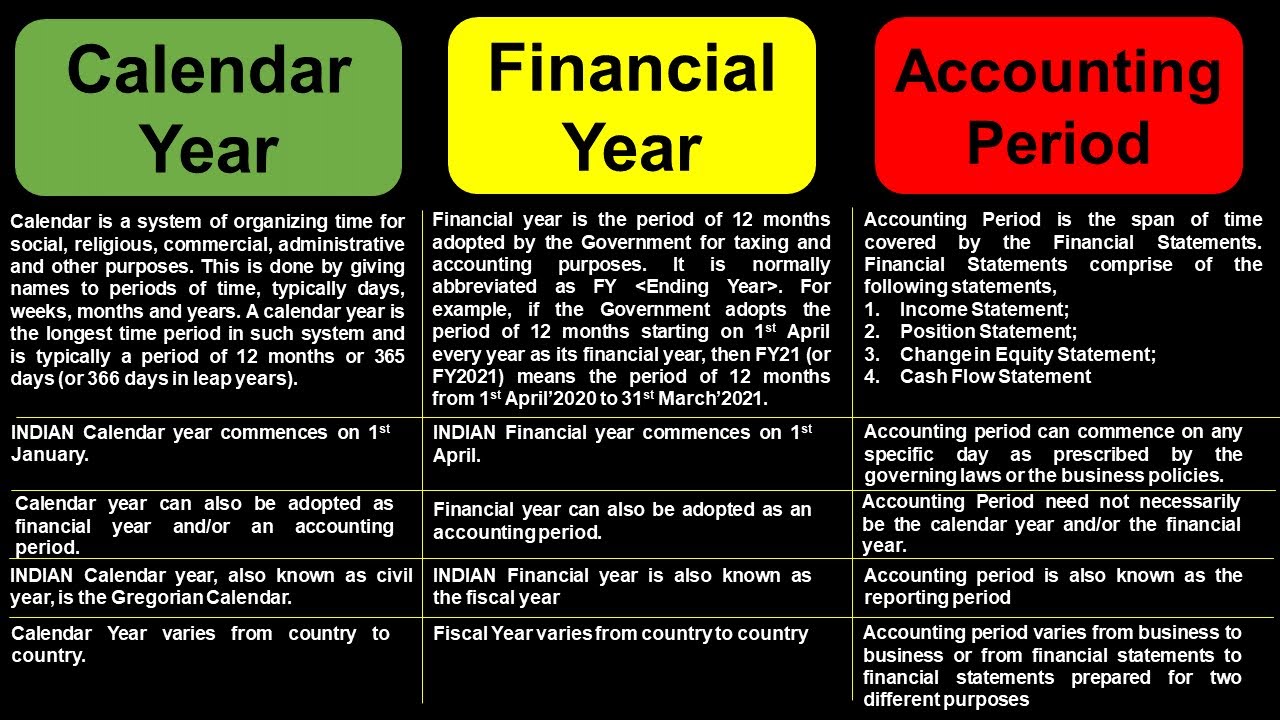

A calendar 12 months aligns completely with the Gregorian calendar, working from January 1st to December thirty first. Its simplicity is its biggest energy. It facilitates simple comparability with business benchmarks, simplifies tax reporting, and streamlines communication with stakeholders who’re accustomed to this customary interval. Most companies, particularly smaller ones, go for a calendar 12 months attributable to its inherent ease of use and established infrastructure.

A plan 12 months, alternatively, affords flexibility. It is a 12-month interval that begins on any date chosen by the enterprise. This flexibility permits corporations to tailor their fiscal 12 months to their distinctive operational cycles, aligning reporting durations with pure enterprise peaks and valleys. For instance, an organization whose gross sales surge through the vacation season may select a plan 12 months that ends in January, permitting for an entire evaluation of the essential vacation gross sales interval earlier than the beginning of the following fiscal 12 months.

The Strategic Benefits of a Plan 12 months: Tailoring Your Fiscal Rhythm

The flexibleness inherent in a plan 12 months supplies a number of compelling benefits, making it a superior selection for companies working in particular industries or with specific operational traits:

-

Optimizing Reporting and Evaluation: A plan 12 months permits companies to align their fiscal 12 months with their pure enterprise cycles. Think about a seasonal enterprise like a ski resort. A calendar 12 months would pressure them to report on their peak season (winter) and low season (summer season) collectively, obscuring the true efficiency of every interval. A plan 12 months ending after the winter season supplies a transparent image of annual efficiency, facilitating higher strategic decision-making.

-

Improved Budgetary Management: By aligning the fiscal 12 months with operational peaks and troughs, companies can higher forecast and handle their budgets. A plan 12 months permits for a extra correct reflection of money move, enabling proactive monetary planning and useful resource allocation. This exact budgetary management could be notably useful for companies with fluctuating revenues.

-

Enhanced Aggressive Benefit: A well-chosen plan 12 months can present a strategic benefit over rivals working on a calendar 12 months. For instance, an organization may select a plan 12 months that enables them to launch their annual report earlier than their rivals, giving them a head begin in investor relations and market positioning.

-

Streamlined 12 months-Finish Processes: A plan 12 months permits companies to conduct year-end processes throughout a interval of decrease operational exercise. This will result in elevated effectivity and decreased disruption to core enterprise features.

-

Improved Inner Management: A plan 12 months permits companies to raised align their inner management techniques with their operational rhythms, doubtlessly bettering the accuracy and reliability of their monetary reporting.

The Simplicity and Familiarity of a Calendar 12 months: A Basis for Stability

Regardless of the strategic benefits of a plan 12 months, the calendar 12 months stays a well-liked selection attributable to its inherent simplicity and familiarity:

-

Ease of Comparability: The widespread adoption of the calendar 12 months simplifies comparisons with business benchmarks and competitor efficiency. This ease of comparability is efficacious for buyers, lenders, and different stakeholders.

-

Simplified Tax Reporting: Aligning with the calendar 12 months simplifies tax preparation and compliance, lowering administrative burden and potential errors.

-

Streamlined Communication: Utilizing a calendar 12 months simplifies communication with stakeholders who’re accustomed to this customary interval. This consistency can enhance effectivity and scale back misunderstandings.

-

Decreased Complexity: The simplicity of the calendar 12 months reduces the executive burden related to managing a distinct fiscal 12 months, releasing up sources for different enterprise actions.

Selecting the Proper Match: A Detailed Evaluation

The optimum selection between a plan 12 months and a calendar 12 months relies upon closely on the precise circumstances of your enterprise. An intensive evaluation ought to think about the next elements:

-

Trade Norms: Look at the frequent practices inside your business. If most rivals use a calendar 12 months, aligning with them may provide advantages by way of benchmarking and comparability.

-

Enterprise Cycle: Analyze your enterprise’s operational cycle. Does your enterprise expertise vital differences due to the season in income or exercise? In that case, a plan 12 months is likely to be advantageous to align your reporting with these cycles.

-

Money Stream Patterns: Look at your money move patterns all year long. A plan 12 months can permit you to higher handle money move by aligning your reporting with durations of excessive and low exercise.

-

Tax Implications: Seek the advice of with a tax skilled to grasp the tax implications of selecting a plan 12 months. Whereas there is likely to be some preliminary complexities, the long-term advantages may outweigh the short-term challenges.

-

Inner Sources: Assess your inner sources and capability to handle a plan 12 months. In case your staff lacks the experience or sources to deal with the extra complexities, a calendar 12 months is likely to be a extra sensible selection.

-

Stakeholder Expectations: Contemplate the expectations of your buyers, lenders, and different stakeholders. If they’re accustomed to calendar-year reporting, deviating from this norm may require extra rationalization and energy.

Modern Functions and Superior Methods: Past the Fundamentals

The selection between a plan 12 months and a calendar 12 months isn’t merely a binary choice. Modern companies are leveraging the pliability of plan years to develop superior methods:

-

Information-Pushed Resolution Making: By analyzing historic information and projecting future efficiency, companies can select a plan 12 months that optimizes their reporting for extra correct insights and improved decision-making.

-

Strategic Alignment: Aligning the plan 12 months with key strategic initiatives, reminiscent of product launches or advertising and marketing campaigns, can improve the effectiveness of those initiatives by offering a clearer view of their impression on general efficiency.

-

Dynamic Adjustment: Some companies may even think about dynamically adjusting their plan 12 months over time, based mostly on altering market situations or enterprise methods. This degree of flexibility requires cautious planning and execution however can provide vital benefits.

-

Integration with Know-how: Leveraging accounting software program and different technological instruments can considerably simplify the administration of a plan 12 months, mitigating the potential complexities related to a non-calendar 12 months.

Conclusion: A Strategic Resolution with Lengthy-Time period Implications

The selection between a plan 12 months and a calendar 12 months is a elementary strategic choice that impacts each side of your enterprise, from monetary reporting and budgeting to operational effectivity and stakeholder communication. Whereas the calendar 12 months affords simplicity and familiarity, the pliability of a plan 12 months can unlock vital strategic benefits for companies with particular operational traits or strategic objectives. An intensive evaluation of your enterprise’s distinctive circumstances, coupled with a forward-looking perspective, is essential to deciding on the optimum fiscal 12 months that may drive long-term success. By rigorously contemplating the elements outlined on this article and consulting with related professionals, you can also make an knowledgeable choice that aligns your fiscal rhythm with your enterprise’s strategic ambitions, finally resulting in excellent efficiency and superior outcomes.

Closure

Thus, we hope this text has supplied useful insights into plan 12 months vs calendar 12 months Modern Excellent Superior. We hope you discover this text informative and useful. See you in our subsequent article!